We recently held our Asia-Pacific Annual Conference in Brisbane. It was a great success as are all of our conferences but the most gratifying part of it for me was our launch of the Paul O’Byrne Cure for Cancer Foundation. Continue reading “The Paul O’Byrne Cure for Cancer Foundation”

An old Cherokee story

The Cherokee Indians, as is the case with all native people, use insightful stories to convey meaning and seek understanding of people and their behavior. One such story that the elders tell their children is about fighting wolves. They say that inside every person are two wolves constantly fighting. One of these wolves is an evil character who is angry, jealous, lazy, impatient, self-centered, egotistical, negative, irresponsible and unforgiving. The other wolf is loving, kind, generous, humble, caring, enterprising, positive and responsible. Typically, a child when told about this will ask “which wolf wins?” To which question the elder will answer “which ever one you feed.” Continue reading “An old Cherokee story”

Remember when you were a kid and anything was possible?

I well remember when I was a kid thinking anything was possible. Superman was my hero and I was convinced that I could fly like him so with a raincoat attached to my neck, a 15 foot ledge to spring from and a tree branch only 10 feet away I proceeded to test that thought. Needless to say my broken wrist confirmed that, at that time anyway, I quite obviously still had some flight training to do. In later years I discovered that airline assisted flight was more comfortable and convenient. Continue reading “Remember when you were a kid and anything was possible?”

Lessons from the Greatful Dead

Several years ago I attended a Grateful Dead concert in San Jose with a bunch of Canadian friends. We were accompanied by about 20,000 other people most of whom describe themselves as Deadheads—which is another name for extremely loyal (bordering on fanatical!) fan who range in age from teenagers to the oldest baby boomers. The concert was incredible in every respect and it really got me thinking about organizations, leadership, customer loyalty and most importantly synergy. Continue reading “Lessons from the Greatful Dead”

We have an important job to do

On May 12 the Australian Treasurer brought down the Federal Budget. Predictably it revealed an enormous deficit and much talk about the recession and economic realities etc. I find it so thoroughly depressing to listen to all the negative drivel coming from the mouth’s of all the naysayers and championed by a media that delights in putting a negative spin on everything. An absence of business and consumer confidence is a primary cause of a recession and without wishing to over-simplify the solution, a fast recovery is much more likely if the media would either shut up or better still, focus on the positive things that are happening in the world especially emerging trends that auger well for a solid recovery. We can stop having a recessionary mindset if we just stop measuring and reporting on GDP until it starts to move back into the black! Continue reading “We have an important job to do”

Podcast: Play in new window | Download

A thought on the dictatorial management style

I was talking with a young Australian Chartered Accountant recently and he told me he had just received his full CA qualification and was planning to leave the firm he’d been with for several years. When I asked why, he said he was sick of working for a dictator!

I recall reading an excellent comment on this by Hans Finzel in his book, The Top Ten Mistakes Leaders Make. I quote:

No one likes to live under dictators–they take all the fun out of life and work! Dictators in the business world hog all the decision-making. They feel that by virtue of their ownership, position, intelligence, or birthright, they are in charge of every key decision that will be made in the company or organization. These traditionalists do not see the value of facilitative leadership or the power of teams. Needless to say, dictators attract weak workers and cannot create a positive, empowering workplace.

I often wonder how common this style of leadership is in professional service firms. I believe it’s more common than many people think or are willing to acknowledge. What a huge cost that is to the growth of the firm, its clients and especially its team members.

Price to Grow Profit not Revenue

In a recent post I referred to memo a business manager sent to his direct reports concerning the need to maintain margin even in tough times. I received a comment from a reader who wanted to know my views about pricing when you have surplus capacity in a industry with many competitors and low entry barriers. His view was that discounting makes sense in such a case especially if you have a lower cost structure. On the surface I would have to agree with that suggestion but I thought it would be useful to throw a few more thoughts around.

Pricing is both and art and a science but it’s the “science” bit that I’m going to refer to now. It is arguable that the pricing decision is the most important decision that any organization makes given its critical impact on revenue.

Other things being equal if you raise price the quantity of your products or services that customers are willing to buy will fall and vice versa when you drop your price. It’s important to note, however, that a decline in the physical volume of sales as a result of a price increase does not necessarily result is a decline in revenue. It might (and in fact often does!) result in an increase in revenue for the simple reason that people do not consider price to be the most important factor in their decision to purchase or, to put that another way, “all things” are NOT equal. Economists refer to this situation as inelastic demand and the more effectively you can “brand” your products or services and/or differentiate your business in other ways, the more pricing power you will have.

The big point is that you should always focus on pricing for profit not for revenue. If you have a lower cost structure than your competitors then you can drive home this competitive advantage by pursuing a low price strategy. If there are enough customers who consider price to be an important factor in their purchasing decision this would be a successful strategy–but note, the essential strategic focus is profit not revenue. Even though you have a cost leadership advantage you may also be able to differentiate in other ways that are valued by customers in which case you may choose to “bank” your cost advantage and let those other points of difference drive your volume.

But what if you do not have a cost leadership position? There may be times when you must consider lowering your prices. For example, suppose there is a downturn in the economy and a key customer demands a price drop; you probably don’t have a lot of choices unless you have significant supplier power to match your customer’s buying power. As long as the agreed price is greater than the variable costs associated with supplying the product or service you will achieve a positive contribution margin. This would be a rational pricing decision in the circumstances.

The above situation should be viewed as a special case because simply generating a positive contribution margin will not necessarily yield a net profit at the end of the day; this will only occur when your total contribution margin exceeds the total of your fixed costs. Any rational pricing decision needs to be cognizant of costs as well as pricing realities because although in the short term a loss may be tolerated as long as there is still a positive contribution margin, in the long term it will be necessary to raise prices or find some other way to reduce costs in order to return to profitability.

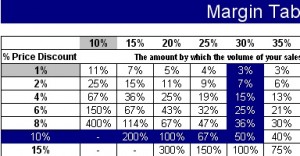

Remember, however, you may not have to drop your prices across the board (this should be an absolute last resort strategy) nor do you have to drop your prices for all of your customers. When you consider just how much additional physical sales volume you need to compensate for a price drop it’s easy to see why such a strategy will inevitably lead to lower profit. The table below shows that 50% more volume would be required to maintain your profitability if you were operating on a 30% Gross Profit and you were considering a price drop of just 10% – even if customers were that responsive to a 10% price cut it’s highly unlikely you would be able to accommodate a 50% volume increase with your existing capacity constraints. You can download this spreadsheet by clicking here.

There are other strategies you might consider. For example:

- Offer a range of product or service offerings with different price points ranging from high to low.

- Articulate very clearly what your value proposition is and price accordingly.

- Don’t voluntarily discount prices.

- Unbundle components of your offering.

- Bundle additional components into your offering (this might be done jointly with another business that deals with the same type of customers as you).

- Turn products into services.

- Turn services into products.

By far and away the most important strategy to implement in tough times is an unrelenting focus on your customer service protocols. For the most part, customers are not moved one way or the other by discounts. If you are attentive to your customers’ needs you should not have to discount to retain their loyalty. What’s most important is that you don’t fall into the trap of believing that in tough times revenue is king. Cash is king and cash flows from profit together with sound working capital management.

No show appointments: Medicos might have an answer

You know how frustrating it is to have a client call at the last minute and cancel an appointment or worse still, just not show up. Not only does it negatively impact your productivity it can be soul destroying when you consider what you could have organized to do with that time. No matter how you look at it, time is our limiting (and non-storeable) resource.

Our friends in the health care industry seem to have got a handle on this issue. Dentists and doctors now routinely contact you the day before your appointment to confirm that you will be there. This serves as a reminder to you as well as an opportunity for the service provider to slot another patient in. Could you do the same thing? Do you do that?

Recently, I noticed an interesting no-show policy used by the University Health System here where I live in Nevada:

“You are required to call our office to cancel 24 hours prior to your appointment. This allows other patients who are in need of a doctor’s care an available appointment. If you fail to cancel 24 hours prior to your appointment you will be assessed a $25 fee which will be added to your account and must be paid in full prior to any follow up visits. If you fail to show up for a scheduled appointment more than twice during a one year period, you may be asked to seek care from another service provider.”

This is not what you’d call a very customer-friendly policy (not that you’d expect that with most of the US health care facilities) however, it does make some sense. When clients fail to show up for meetings they are wasting your time. If they are serial time wasters you should seriously consider telling them “to seek care from another service provider.” Just a thought.

The role of a managing partner

This is about as close as it gets to describing the role of a managing partner.

httpv://www.youtube.com/watch?v=JWymXNPaU7g

What are your thoughts?

A businessman’s view of margin management

I recently had the pleasure of meeting socially with the manager of a large business unit of a listed public company. As any self-respecting accountant would do immediately after meeting someone new, I invited him to look over my shoulder while I did some work on the Fundable Growth Rate model in GamePlan. His eyes lit up and he immediately recognized how valuable this type of analytical tool must be for our members’ business clients. He was so impressed with the FGR application, especially in the current economic climate that I decided to record the conversation we were having so you can get a sense of how business people relate to analytical tools such as this.

Listen to a conversation I had with the manager. It’s a 10 minute chat – 10 minutes well invested as you’ll hear some good advice from someone who thinks just like YOUR clients.

One of the matters that came up in discussion was how the FGR model could be used to graphically show the lunacy of focusing on volume rather than margin in tough times so I gave him a working copy of a small Margin Table application for him to take away and play around with. A couple of days later he sent me a copy of a memorandum he’d just sent to his management team.

I have reproduced his memo below after removing all confidential data but otherwise what you see is what he wrote — this is precisely the sort of analysis every single one of your business clients need to be having with you today.

Hi Team

Please see an attached spreadsheet called Margin Table that graphically shows the negative effects of discounting our pricing to win work and the profit impact of gaining 1 or 2 or 3 percentage points of margin operationally or as a pricing strategy.

As a team we have had many discussion over the last few months on the impact of discounting work just to win a job and what that means from a revenue perspective to ensure we achieve our profit target.

By making the decision to invest our capacity (a finite resource) in lower margin work, as you can see from the table, the pressure that puts on us to bring in more revenue is great. Take our budgeted Gross Profit Margin (GPM) of 25% (currently our YTD is actually GPM 23.5%). If 2009 pans out as expected and economic times become harder and we find ourselves cutting margins to get work or we continually find ourselves chasing jobs on price and cutting margins as a result of competitive pressure we’re going to be for a really tough time.

For example, say we cut our price by 4 percentage points (to a GPM of 21%), to compensate for this deployment of capacity (overhead) at this lower margin we will need to find an additional 19% of revenue to maintain budgeted profitability (or $X.Xm of additional work over and above our budget revenue). With work already being hard to get, that’s going to be hard to achieve.

Exactly the same thing will apply from an operational perspective. For example, if we are loosing 4% on the job due to poor supervision, cost management, poor estimates, etc. the same impact applies. You can also see that if this goes to 10% as a result of both poor management and soft pricing (say a GPM of 15%), we will need to find an additional 67% of revenue ($XX.Xm) over budget to compensate for this and remain at the same profit level.

As you are all aware, any business has an overhead commitment that can deliver a certain capacity. In our business our capacity is not determined by machine output BUT people output (administration, supervision, estimating, sales, management, etc) and as such any overhead investment can only deliver a finite capacity before additional costs need to be brought into the business. As you can see at a 10% erosion of margin any business with our GPM will run out of capacity to deliver the additional 67% of revenue required, assuming it can find the new work, no matter how efficient. As such this business strategy is an irrational and fruitless exercise.

As with all things, the inverse applies (and remember in business it is far easier to loose money than make it). If we can gain an extra 2% at the pricing stage or drive it operationally on the job, that means 7% less revenue we will be needed that year (assuming a 25% GPM). With our revenue target of $XX million an extra 2% means we do not need to find $XXXk worth of work to achieve the same level of profitability. We all know how hard it is to find $XXXk worth of work, it’s usually easier to get an extra 2% operational improvement or increase in price by selling harder the non price benefits of using our services.

This is even more valuable information for the smaller branches as you will run out of capacity far quicker than the larger business units.

I hope this is useful information and please remember it the next time we are having discussions over margins, pricing your next job and why we cannot let them fall. I understand that all jobs must be priced on a case by case basis BUT the overall end result must achieve the budget GPM (in our group for this year it is 25% – that is a 33% mark up on cost) and every fraction of a % drop from this makes life very difficult, to the point of becoming impossible. It will also be a false dawn as everyone will be working hard and feel they and the business are very busy but the end results will not be there financially and this can break morale.

This memo reflects the type of conversation every business advisor should now be having with his or her business clients. In tough times it is margin rather than volume that’s important.

Too many of your clients are knee-jerking into the wrong actions in a desperate bid to maintain market share and you need to be able to show them the way.

Podcast: Play in new window | Download