On May 12 the Australian Treasurer brought down the Federal Budget. Predictably it revealed an enormous deficit and much talk about the recession and economic realities etc. I find it so thoroughly depressing to listen to all the negative drivel coming from the mouth’s of all the naysayers and championed by a media that delights in putting a negative spin on everything. An absence of business and consumer confidence is a primary cause of a recession and without wishing to over-simplify the solution, a fast recovery is much more likely if the media would either shut up or better still, focus on the positive things that are happening in the world especially emerging trends that auger well for a solid recovery. We can stop having a recessionary mindset if we just stop measuring and reporting on GDP until it starts to move back into the black!

One emerging trend that can’t be ignored is the growth of the “middle class” in China. I read recently, that by 2011, 290 million Chinese are expected to reach the bottom rung of the middle class and by 2025 it’s expected that there will be 520 million Chinese at the upper end of the middle class scale. These people will be looking to buy the same things middle class people have been enjoying in western countries for a long time. The demand stimulus that will come from the emerging economies including India, Russia, some ASEAN countries and some South American countries will be the highlight of the 21st century.

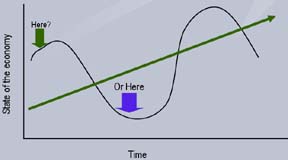

It seems to me that we should be looking at the present situation with a “glass half full” attitude rather than a “half empty” one. In fact, in my view, the glass is actually more than half full. In a recent series of seminars I have been doing I’ve put the proposition: if you were planning to start a business at what stage in a business cycle would you like to be? Looking at the diagram below, what’s your answer?

When I ask the question everyone says they’d prefer to be starting a new venture at the (or near) the bottom of the cycle. That being the case surely it makes sense for us to be really optimistic about the future and looking to make investments in it. It’s also significant to note that the above diagram reflects another relevant fact of economic life: booms and busts constitute the essential fabric of an economy and have done for thousands of years but each successive boom ends at a high position than all those before it. In other words the good times will return and they will be better than anything we have experienced in the past.

In these times of economic opportunity SMEs need the help of their advisors more than ever. In particular they need someone to help them identify and focus on their core business strengths , they need help with managing cash flow and pricing, they need assistance with identifying their pockets of profitability and areas of loss. Importantly they need someone to give them the emotional support required to weather the storm in the knowledge that they are on the right track and they that can capitalize on their strengths and take advantage of others’ weaknesses. Large businesses have CFOs who are there to support the rest of the “C-team”–small businesses do not even have a C-team let alone a CFO. They need their accountant, their trusted advisor, to assume that role. SME’s will lead the world out of recession and to the extent that accountants have the potential to have a dramatic impact on their clients’ profitability (and therefore collectively on GDP) they have an incredibly important job to do.

One of our clients, Cameron Patterson, very kindly reminded me of a small audio segment taken from one of my Boot Camp presentations. It is a short piece where I talk about the real reason we, as professionals, should be helping people run a better business. In my view it cuts to the core of our primary professional purpose and to a very large extent explains why I do what I do now. If you’re interested, click here to listen to what I had to say.

Podcast: Play in new window | Download