This is the story of how O’Byrne and Kennedy changed their business model from an unremarkable suburban compliance practice with 500 clients to a remarkable niche business advisory firm with 50 clients and in the process dramatically increased profitability, client loyalty, and team member engagement while having a life-changing impact on the clients they work with.

For the past month I have had the privilege of spending a lot of time with my good friend, Paul Kennedy, in the Goffs Oak UK office of O’Byrne & Kennedy (OBK). In this blog post I want to share with you some observations I’ve made concerning the potential that accountants have to make a significant and lasting impact on the lives of their clients and their team members based on what I’ve been a witness to in the way Paul works and has organized his firm.

I had intended that this be a quick note about some of the amazing things I’ve observed since visiting with Paul but it’s blown out to a 19,000 word essay so if you’d rather read it as a White Paper click here.

Before I start on this story I first want to mention something that Paul Kennedy (PK) talks about repeatedly in practically every conversation I’ve had with him and that is the seminal role his business partner the late Paul O’Byrne (POB) has had on him personally as a friend, mentor, coach, cheerleader, thought leader, and firm strategist. PK humbly attributes most of what he’s been able to achieve to the vision, guidance, courage, determination, energy, support, and fearless leadership exhibited by POB.

I make this point partly out of my deep respect for POB – who was also a very close friend of mine and someone I learned a great deal from – but also to underline the critical importance of having someone you trust absolutely as a business partner who has the courage to step outside the proverbial box and to see every outcome as either a success or a learning experience. POB’s legacy is reflected in the way OBK has developed over the past 20 years and I’m certain he would be well pleased.

The Observations

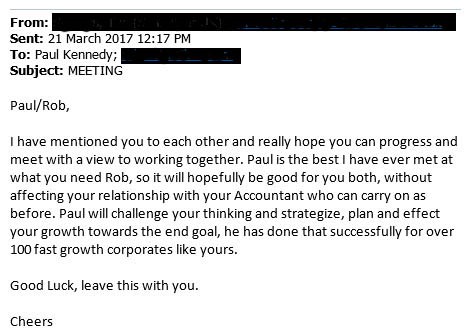

Allow me to share with you an email Paul received last week from a referral source who, I’m told, typically sends his firm about 10 high caliber prospective clients every year. Here’s the email:

What’s really interesting is that Paul rejects most of the prospects either immediately or soon after he does his due diligence because he doesn’t believe there’s going to be good fit. When he showed me the email he said “…it looks to be an interesting opportunity but we probably won’t take on the business.” He added, “on average we only accept 10-20% of the referrals we get each year.”

I bet you’re thinking why wouldn’t he jump at the opportunity to grab a new client; especially one who has been so strongly referred if for no other reason the referrer might be offended and stop sending prospects.

Let me deal with the fear of offense issue first. This referrer is never offended. He realizes that Paul only works with people who meet his strict criteria. If nothing comes of the referral Paul explains why so the referrer is always in the loop and appreciates that there is little downside from referring someone where there’s likely to be a bad fit.

Now to the main issue.

It’s important to understand the fundamental strategy that drives Paul’s practice and that is, he ONLY works with businesses that are owned and/or managed by people he likes and respects, people who already operate successful businesses, and importantly, businesses that he genuinely believes his firm can create value for AND capture value from.

He has several other criteria but these three (likeability, currently successful, and value growth potential) are his most important and he NEVER compromises them by embracing some weak rationalization to justify a possible new source of revenue. Paul subscribes to the view that it’s a lot easier to help someone who is already good become great than it is to help someone who is weak (or perhaps just disinterested) become good.

On receiving a referral like this Paul will take time out to meet with the prospect and get to understand his/her goals, the nature of the business and the circumstances behind the prospect looking for help. He’ll happily discuss strategy with the prospect and often prepares a business improvement plan that if nothing else helps him determine the value adding (and capturing) potential.

The initial conversation with the prospect is never billed unless, occasionally, a prospect requests and agrees to pay for some initial advisory work. But most times it’s not billed because Paul sees it simply as part of his due diligence where he’s trying to figure out what the profit improvement and business value improvement is, and get an answer to the question: will he be able to work well with the client? Patrick Lencioni’s fantastic book, called Getting Naked: A Business Fable about Shedding the Three Fears That sabotage Client Loyalty, explains why this strategy can be so successful as the precursor to a profitable consulting engagement.

Paul doesn’t always get the client selecton right in which case he does not hesitate to respectfully fire the client. Here we see another subtlety in the way he’s fashioned his business model. He makes it very clear to his prospects (and continues to do so with his clients) that he is only interested in working with them if he feels he can continue to add value to their business and life. If he feels he’s not doing this for whatever reason, including not particularly liking the client, it is very easy for him to have an exit conversation because he can, with total honesty, explain that he no longer feels he’s able to add value and he would like to help them find another service provider who is better suited to their needs. No one is offended although he tells me some clients point blank refuse to leave which is the only dilemma he has to face.

Paul is not interested in profit growth for its own sake. What he’s interested in is what he calls “quality client growth that yields quality profit that comes from quality revenue” and that in turn comes from enjoying the work he does by working with people who respect and value his contribution, who treat him and his team members well, and who view him not just as a so-called “trusted adviser” but as a key business partner.

By sticking to this formula Paul has built a phenomenally profitable (as in off the charts!) practice that, to use Warren Buffet’s words, causes him to “skip to the office each day.” This, he says, is quite a different goal to building a phenomenally big practice and to have to deal with all the personal and the financial challenges that often brings. By the way, fast growth is not necessarily a bad objective it’s just not Paul’s.

I intentionally used the phrase “off the charts” above. Let me explain why. Some time ago Paul wanted to see how his practice was performing relative to others so he decided to participate in a benchmarking study. Because he doesn’t have time sheets he couldn’t answer most of the questions except for number of team members, total revenue, total and, where asked, certain line item expenses and net profit. He was called by a person handling the data integrity and when he explained how his practice operated she told him his numbers were so off the chart they could not use his data but would send him a copy of the final report as a courtesy.

I talked to him about the process he uses to determine his fees but that’s not something I intend to address in this post other than to mention he said it’s hard and has absolutely nothing to do with the time he actually spends on a project. Sometimes he loses and most times he wins but the client is always happy with the value received. Then he added, “… the losses are tiny compared to the wins because of the client selection criteria we use and the nature of our work.”

In the course of our conversation about value created and the pricing challenge, he mentioned a case where he was helping a client in a negotiation that at the end of the day resulted in the client getting an additional £1.3 million over what they were willing to accept. When I said “how did you make out with the fee on that project?” he said “not too good actually but if I look at all the time we put into the total project my guess is we still netted at least £1,000 per hour!” That would never have happened if he’d been billing by the hour.

Success Leaves Clues

I first heard the phrase “success leaves clues” from the late Jim Rohn. It struck me as a very insightful idea about the value of mimicking the activities of successful people but unfortunately it turns out that success is very hard to copy because it is driven by so many things, many of which are tiny and often invisible.

There are a few things you could (easily) implement that have been put in place by Paul. If you are able to put all the pieces together (that’s the hard part) you’d find success did leave clues. But I can tell you right now you’ll need some courage to do what OBK have done – for example, after they returned from a Bootcamp nearly 20 years ago they let go 450 of their 500 clients over an 18 month period because those clients did not fit their client selection criteria. After a while they completely stopped using timesheets which, amongst other things, forced a complete separation between work activity and pricing. For some firms, initiatives like this are too scary to contemplate. Some argue it’s impossible to fire clients and grow your practice or manage a firm without time sheets. For others like OBK, these choices are the things that force a re-think of their business model; that is, the means by which they create, deliver and capture value.

The Perceived Value Curve diagram below explains the rationale that underlies Paul’s strategy. In his view, clients consider compliance services to be something that needs to be done well and they simply want it done quickly and at the lowest possible cost. They’re price sensitive to the extent that if they discover a firm down the road can do the same job (they have no idea of the quality of the work) cheaper they will not be happy.

Compliance services will take a defined period of time (up to point A) which will vary in length for different clients but for any given client the length of time does not increase the perceived value to the client and may even reduce it. The relatively low and flat perceived value characteristic associated with compliance is the reason Paul is very happy NOT to do this work at all. In fact he mentioned in passing “we like to start where other firms finish.”

The Perceived Value Curve

On this note, he shared a story with me about a prospect who wanted to come on board and as a professional courtesy Paul called the prospect’s current accountant to ask if there’s any professional reason he should not accept the engagement. The accountant told him he had no objection at all and in fact was quite happy for the client to go because he was very fee sensitive. To this day, the previous accountant still does not know that the client agreed to pay OBK a fee that was 10 times higher than he was previously paying his accountant. The critical point here is it’s not “fee” sensitivity it’s “value” sensitivity. If you have a client complain about your fees it’s really a value statement.

Projects that create incremental value will inevitably take more time and in the process the perceived value increases as the results from the work become clear. Initially, the additional time invested may not result in a demonstrable increase in value because it’s foundational i.e. it takes some time (from A to B) to really to get to understand how a business works (the discovery phase) and put in place some initiatives that yield results in due course. This is a critical time because the client may be having second thoughts about his/her decision to seek your advice. It is therefore a time when very high quality conversations need to be had with the client to give assurance that patience is needed and, incidentally, it’s also a reason why time-based billing simply does NOT work for this type of engagement.

The work that gets done in the B to C time frame is where the value actualized increases dramatically. It is this work that the client really understands what value you bring to the table and it becomes way more “top of mind” than the compliance work. It’s also the work that locks the client into your firm because it is not something he/she believes they could get elsewhere and you have become a critical part of their management team.

It’s possible that the perceived value curve may continue on an upward trajectory but it’s more likely that a point will be reached where it levels out (point C) into a type of maintenance mode. Interestingly, this is where the amount of work effort required to support the perceived value declines but the fee doesn’t – this is another reason why time-based billing makes no sense for this type of work.

On this point, Paul said to me on one occasion after spending a day strategizing with a client: “I sometimes have to pinch myself when I realize how disarmingly simple what I do is.” I asked for clarification and he said something like, “I suggest to people some ideas that are just common sense and yet they take them on board as a revelation and are genuinely excited. We then put in place an action plan and when we next meet we follow up on that. Inevitably the results flow and the client is blown away!”

This was not an Overnight Success

Paul is quick to point out that the development and refinement of their business model did not happen overnight. There was a lot of trial and error – in fact one error for nearly every trial! However, real results started to happen after slogging away for a decade and have continued on an upward trajectory. This is the ‘Flywheel Effect’ effect that Jim Collins talks about in his book Good to Great: Why Some Companies Make the Leap and Others Don’t. Which incidentally reminds me that although OBK was a good firm when they started this journey – 500 clients built from scratch starting on O’Byrne’s kitchen table, they were experiencing good growth, and were profitable – but it did not become a great firm until they changed their business model and that took time.

Think about it in the context of Collin’s G2G model:

- Level 5 leadership – both Paul O’Byrne and Paul Kennedy reek of level 5 leadership qualities. They’re incredibly humble yet have a “unwavering resolve” to build a sustainable business that creates great value for their selected business clients.

- Right people on the bus in the right seats – they have built an amazing team of talented people. They invest heavily in training and personal development. They give their team a lot of client contact and they’re very well compensated. Based on Daniel Pink’s 3 sources of motivation: autonomy, an opportunity for mastery, and achieving a real sense of purpose the OBK team scores 10 out of 10 on every one. Further, the OBK culture is a textbook example of how to avoid what Pat Lencioni from the Table Group calls the 5 Dysfunctions of a Team – the title of his best-selling book.

But for OBK, the right people on the bus does not just apply to their team, it includes their alliance partners and their clients hence the reason for firing so many – they could not see how they could realize their ambition to make a difference while making a profit if they continued working with people who don’t want to make a difference themselves.

- Confront the brutal facts – OBK could see the writing on the wall for firms that focused exclusively on low to mid-level compliance services that were becoming commodities with margins being squeezed as technology increasingly levels the playing field. More importantly, POB and PK did not like that type of work or many of the clients who wanted it. With that view in mind they had the guts to abandon their old business model and work hard at teaching themselves to be seriously good (as in great) business advisors.

- The Hedgehog Concept – OBK understood the sweet spot was where their skill to become the best in their world at the sort of work they do intersects with their passion, and which selected business people would be willing to pay a premium price for.

- Culture of Discipline – Collins talks about discipline around the idea of freedom and responsibility within a bounded framework. This is precisely what you see at OBK. They have developed very clear and comprehensive protocols for delivering the valuable services to their clients. The comments I made above about embracing Dan Pink’s thoughts on drivers of motivation also reflect the discipline dimension.

- Technology Accelerators – OBK use technology to deliver their services e.g. most of their clients’ accounting systems are in the cloud but they have never seen the “cloud” as the source of the value they deliver it is simply the means. What they do understand more clearly than most is that with a cloud-based accounting system it’s possible to deliver monthly financials which in turn, and together with other KPIs, leads to better business outcomes.

- The Flywheel Effect – The impact of their first efforts with each transformation initiative was almost imperceptible. Yet, over time, with consistent, disciplined actions propelling it forward they built momentum that finally led to a breakthrough which continues today.

The story of the OBK transformation from a typical small suburban accounting practice like all the rest to a niche business development firm would be incomplete without reference to an important strategic choice they made early on.

Initially when they were forming a vision for what they wanted their business to look like, they contemplated getting out of compliance work all together. But after giving it a lot more thought they realized that if they started a consulting-only style of business their competitors would be other consulting firms some of whom were clearly more powerful and differentiating themselves would be very difficult.

On the other hand, by staying in the accounting profession but focusing on business development work with a compliance front end (or in their mind back end) their direct competitors were few and far between and differentiation was a no-brainer – in fact, the most common comment they get for a new client is “I’ve never seen an accounting firm like yours.” This is what you might call a classic Blue Ocean strategy in a Red Ocean environment and as it happens, in my view, was absolutely the right thing to do.

Clients Need to Learn before they can Earn

One of the keys to Paul’s rather simple strategy is the willingness of his clients to listen to him, to consider his ideas with an open mind, to work with him to refine and test them, and then to focus on their implementation.

With that in mind they quickly learned at OBK was that not all clients who had potential had enough basic knowledge about the discipline of growing their business. For this reason (and a couple of others) they decided to put together a client education program which subsequently became what they now call the obkMBA.

They describe the aim of this course in the following way: “This is a highly focused course that covers the essential areas of business leadership and management as they apply to smaller businesses in just 30 hours. The monthly 3 hour sessions start at 8am and finish promptly at 11am.”

They run the course every year with 8 to 10 participants. They charge a significant fee for the course which contributes to profitability but there are several more important reasons for offering the course:

- By charging a significant fee, it filters out people who aren’t serious about making an investment in their own learning and being willing to contribute to the group.

- OBK occasionally offer scholarships especially for representatives of spheres of influence (e.g. bank managers) and for some people involved with charitable organizations and the price therefore legitimately reflects the value of the scholarship.

- It’s a very effective way to differentiate the firm from other accounting firms in the area and, in fact, the country. This is something that gets talked about because, in Seth Godin’s words, it’s remarkable. Not surprisingly the bank manager who sent Paul the referral email shown above participated on the course – does that give you any ideas?

- Because the course is a “big deal” within the firm it reminds OBK team members – most of whom have been on it by the way – of what the firm does for its clients not only as an educator but also as a facilitator of the things people learn from the course. In other words it serves to reinforce what they are there to do – their sense of purpose.

- It’s an amazing sales and marketing tool for the firm. In a typical year one third to a half of the participants are not existing clients. The course gives both Paul and the participants an opportunity to get to know each other with a view to perhaps working together in future. Some of their very best clients have come from the course and others have been referred by people (which includes bankers and other people of influence) who have been on the course.

It’s important to note this is not the main reason for the course but I have met several of the firm’s clients who have completed it and they absolutely sing its praises – words like “life-changing” are not uncommon. Many of them now send their employees on it which has a positive impact on their business and importantly, sends a message to the team members that their boss wants to tangibly help them grow and achieve their full potential. One client has even retained Paul to run it in house as a <Name of Business> Academy.

- There’s one more huge benefit from offering the course but if I told you I’d have to kill you …. actually, I feel generous so I’m going to share this fact: teaching is by far and away the best way to learn so by offering this course you’re increasing the value of your own and your firm’s intellectual capital. The amount of preparation you need to do is minimal because you really only have to “stay one lesson ahead of your students” so if you take the view that learning is a lifetime

I have talked about the obkMBA for as long as I can remember and when I got the chance to visit with Paul and spend some serious time in the UK observing the masterful way he worked with his clients I jumped at the opportunity to learn more about it. For years I have been badgering him to make it available to other firms so that they can position their advisory services in a more robust manner. Understandably, he’s always been too busy doing the things that cause him to “skip to the office” each day so I asked him to give me a room and a screen and I’ll help him package it for distribution to a wider audience.

Right now we’re talking to several accounting firms about the course design, the implementation protocols, and the pricing tactics. If you think this is something you might be interested in helping Paul design a product that you could see the possibility of implementing it in your own firm please drop me an email at ric.payne@principa.net and/or share your thoughts as a comment to this post.