Michael Houlihan and Bonnie Harvey founded Barefoot Wine in 1986 almost by accident. They knew little about wine and had no idea what they were letting themselves in for at the time. They sold the business to E & J Gallo in 2005 and what they created has become the world’s largest selling wine brand. The story of how this amazing business was built is delightfully explained in their fantastic book The Barefoot Spirit: How Hardship Hustle, and Heart Built America’s #1 Wine Brand. This book should be required reading for anyone contemplating pursuing an entrepreneurial career and while you’re taking a peek at that book, grab a copy of their most recent one The Entrepreneurial Culture: 23 Ways to engage and empower your people – does that hit a chord? But that’s not my reason for posting this note.

Recently I had the pleasure of playing host to Michael and Bonnie at my home in Australia (yes I do hang out with famous people) and in the course of a long dinner with them and some other friends I was reminded of the unbelievable power of what they call Worthy Cause Marketing.

I’ll leave it to you to learn more about that by reading their book and visiting their website – you won’t be disappointed I can assure you – but in essence it involves getting attention for your product or service by using it to promote attention to a worthy cause that aligns with your customers’ or their customers’ interests.

Michael and Bonnie executed this marketing strategy brilliantly not because it seemed like the right thing to do but because, being a tiny business when they started, they had no resources to invest in traditional marketing initiatives AND because it aligned with social or community causes that they personally believed are worth supporting. In other words, this was a textbook execution of doing good by being good.

When I was in practice we did a couple of “worthy cause” marketing initiatives that gave our firm great positioning and which helped us build our brand as an accounting firm that was focused on helping people grow successful businesses and improve the level of financial literacy in our community.

Initiative 1: SIMBIS

When I was teaching at college I ran a class called Advanced Management Accounting and another called Strategic Management. For those two classes, I wrote a business simulation game that teams (or individuals) played by making 5 decisions over 8 periods (quarters) in relation to price, marketing allocation, production schedule, capacity acquisition and surplus cash investment or shortfall. Based on these decisions my program would allocate market share to the participating players by applying some quite sophisticated algorithms that would factor in random shocks like factories burning down, interest rates rising because of inflation etc.

The purpose of the game was to get students to think ahead, use all the (incomplete) information they have available, work together as a team, create their own planning models, determine optimum pricing policies, the importance of deciding on and sticking to a coherent strategy, understand the difficulty of operating in an uncertain environment, appreciate the difference between profit and cash flow, be able to read and understand the informational content of financial statements etc. etc.

The students loved it! AND they learnt a lot not the least of the lessons being that accounting has a huge role to play in decision making not just keeping the score.

But the worthy cause bit appear when I move from academia to public practice.

It occurred to me that year 10 high school students (15-16 years old) who were studying economics or commerce could play this game and would learn something about business, about accounting, about or firm (Rutherfords), and about themselves. So it got funding from IBM and from Westpac Bank (one of Australia’s largest banks) to get the game up and running and provide funding for manuals (there was no internet or digital media available in the late 1980’s!) and to provide a cash price for the winning schools’ libraries.

We ran the game for 3 years from memory and I can’t remember the exact number but I think we had about 400 students from 15 high schools participate. I personally visited the schools to describe the game and I used that visit as a recruiting exercise – you’ll be amazed at how appealing you are as a potential employer to highly talented people when you do something like this rather than visit with 20 other firms at a “careers night.”

The point I want to make here is that at the time we did not see this as a marketing initiative but that became obvious soon enough when we started getting visits from parents seeking information about our firm who’s children were playing the game. We also got great newspaper coverage – the results were published in the local paper every 2 weeks. We hired several extraordinarily talented people as trainees after they graduated high school and started their tertiary study.

But as I look back I think the most important element of this was we helped some high school students get a perspective on the competitive cut and thrust of business and to view it as a career worth pursuing. It gave commerce students an appreciation of the role accounting can play in economic development – I always shared with them the idea that profitable businesses add to Gross Domestic Product and that is the measure of living standards, that losses reduce our standard of living and that people with business savvy are therefore net contributors to our society.

Your could do the same thing in your community.

Initiative 2: Financial Literacy Training

One of the services we offered to our clients and prospects very early in the piece as training in how to read and understand financial statements and in particular use them to make sensible business decisions. Initially we called this one day program an Advanced Financial management Program. We now call it the Practice Financial Management Program.

Interestingly, no other accounting firm in our community did anything like that. I don’t know why not because it wasn’t a secret. Nor was the fact that our firm was growing at close to 30% a year. That growth rate was not due to the AFMP but the AFMP was one of the things that gave us the right and the ability to put a stake in the ground to lay claim to being the go-to firm for business.

But we didn’t stop there.

One of the parent’s of a boy participating in the SIMBIS game was the President of the P&C association and he asked me if I would do a presentation one evening on personal financial management for the student body from several schools. The theme being something like “Prepare Now For the Future: Financial Strategies for Young People.”

It turns out the boy apparently listened to my talk and most importantly did something about it. When I was in Australia earlier this year I got a call from his father, who had became a client but had retired after selling his business, inviting me to a BBQ to meet “someone of interest.”

The “someone of interest” happened to be his son who I shall call Marcus. Marcus was now 43 and when I arrived at the house I didn’t recognize him but he said “I want to thank you,” “how so” I said. “Thanks to you I’m pleased to say I own my house and have an additional net worth of well over a million dollars and growing.”

Frankly I was gob smacked. I thought he must be mistaking me for someone else and then he reminded me of the evening seminar. It’s absolutely amazing how 90 minutes can have such a profound influence on someone’s life.

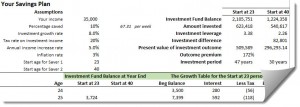

We got to talking about how he got to be financially independent and it turns out he was moved by a spreadsheet I shared with them (it would have probably been built using VisiCalc on an Apple IIe) that showed (with the help of overhead slides) what a huge difference (as in life changing) starting a savings plan at age 23 rather than 40 can have on your asset growth by the time you reach 70.

Apparently he immediately started to put aside 20% of his income and as he build up is cash pile he leveraged it into property and stocks and has created an asset base that far exceed my spreadsheet projection. He said he’d taken a few hits along the way but has doggedly stuck to his savings and investment mindset.

This conversation left me feeling pretty please with myself I must admit but it occurred to me that every single accountant on the planet could have done what I did. Can you imagine the impact that would have on the people you touch and the communities you live in.

This is another classic example of worthy cause marketing. We picked up clients from doing these sorts of things without trying to sell accounting or business development services. As the saying goes: “people don’t care how much you know until they know how much you care.”

So with all of that said.

Here is my challenge to you.

When I got back to the US I reconstructed the spreadsheet I built for that presentation back in the late 80’s. If you get the urge you might like to download it with my compliments and run it by some of your clients or more importantly their children. Here is an idea: invite your clients to bring their adolescent children to a seminar called “Prepare Now For the Future: Financial Strategies for Young People.”