It was a dark and stormy night. The power was out and I heard the back door squeak. I was sure someone was in my kitchen. I called out but I couldn’t have expected what was about to happen …

Actually, it was a beautiful crisp, sunny Autumn day at Lake Taupo which is a stunningly beautiful place in the center of the North Island of New Zealand. I was presenting at a post-Boot Camp business development implementation program when one of the delegates shared her experience using our protocols and tools to deliver Business Development (BD) services to her clients.

Here’s my recollection of the essence of what she said.

This all made so much sense when I was at Boot Camp. I couldn’t wait to get back to the office and introduce my clients to my new BD service line. I got some early traction but before too long I hit a brick wall when I realized that the clients I had “sold” the service to just weren’t implementing anything and were questioning the value of the process.

My first thought was the location of my practice was such that the type of clients I had access to were just not BD candidates. I re-listened to the Boot Camp tapes and reviewed my notes and then it hit me—Ric said “the absolute key to growing a quality practice is client selection.” Once I focused on taking more care in selecting the people I chose to work with everything changed. It turned out to be a slower process than I had hoped but the foundation I built was strong and my practice never looked back.

This story plays out over and over again.

In this post I focus on the economic rationale for having strict client selection criteria that address two principal issues: (a) the likelihood that a client’s business will survive a reasonable period of time, and (b) the likelihood that the client will be conducive to investing in the firm’s advisory capacity to create business value.

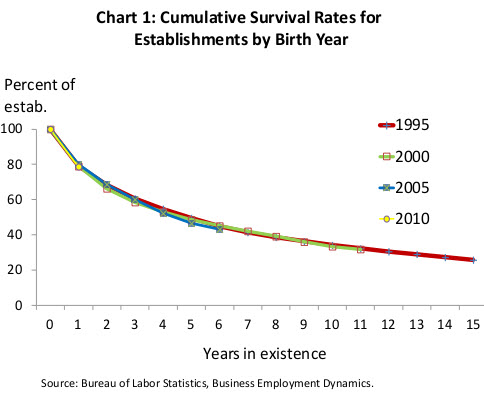

The figure below which from the US Bureau of Labor Statistics shows the cumulative survival rates for start-ups by birth year.

This chart highlights 4 important things:

- There is an amazingly consistent pattern of decline for each of the four birth year cohorts. This suggests that there is a natural law of business survival in play but most importantly it reminds us that other things being equal (which they aren’t as I suggest below) the probability of a start-up surviving 10 years is almost certain to be about 33%. It’s sobering to note that double zero roulette offers 46.37% odds for a Red/Black or Odds/Evens bets.

- The probability of a business surviving 3-5 years lies in the range of 45-60% – let’s say about 53%. For every client you lose during that time you’ll need to pick up another just to stay where you are. This means, amongst other inconveniences and costs, you’ll incur a repeat of on-boarding costs as you familiarize yourself with the new client.

- Once a business gets to year 5, the probability of it being around for at least 10 years rises to 62% – better odds than roulette. In other words if you start a professional relationship with a client who has been in business for 5 years there’s a 62% chance the relationship can last for at least 10 years. It’s therefore a better bet to invest your time and expertise with that client than a startup.

- Once you get to year 10 the probability of lasting survival is very high. That’s not to say these businesses will be highly profitable because most of them probably aren’t but they are obviously profitable enough to survive.

The data reflected in this graph explains why I have always believed that you should not work with start-ups if your objective is to drive the long term value of your firm.

That said, I also believe you should use several other criteria that will help you assess very early in a relationship with a client if not before a relationship exists whether you are going to be able to create and capture value in the relationship.

This too is a key to driving both the profit generating potential of your firm and its value as a going concern. When I was in practice I used 11 criteria to assess clients for business development work. They are:

- Has been in business for at least three years and preferably longer

- Has a pleasant, outgoing personality

- Is willing to listen to advice

- Has a positive disposition

- Is technically competent – experienced in the industry and/or role

- The business is profitable

- The business is not chronically undercapitalized

- The business is not dominated by a small number of customers or suppliers

- There is a clearly established demand for the product or service

- The business has scope for product or service differentiation through innovative marketing or activity re-alignment

- The business has scope for improved productivity through innovative management planning, control or business model re-design

Rarely will a person meet all of the criteria but I repeatedly found that if a client or prospect failed on more than 2-3 of them the relationship turned out to be average at best and not at all good at worst.

Rather than try to present my analysis and conclusions in a long blog post I decided it is important enough to write a White Paper on it which you can download by clicking this link. The White Paper is supported by a spreadsheet I created to run the numbers and you can download that by clicking on this link.