Formulating a business strategy is essentially about making choices that will give you confidence that you’ll achieve a challenging goal which, if you’re intent on being the “best” in your class, that might be achieving an industry-leading ROIC from having created a sustainable competitive advantage. Of course, nothing is sustainable forever which is what makes formulating strategy a “forever” job of management.

The choices required in formulating a strategy include such issues as:

- What is our goal and how will it be quantified?

- What customers will we target and in what geographies will we operate?

- What jobs are those targeted customers trying to get done that we could (or do) have a solution for?

- In what significant ways will our customer value proposition differ from rival firms – will it be low price or performance related premium value?

- What resources and operating capabilities will we need, and what channels will we use, to deliver that CVP?

- What organization structure, decision rules and decision rights, and performance metrics will we adopt to deliver our intended CVP?

Developing a competitive strategy is not an annual event. It’s an on-going project that demands the attention of top management but most importantly it needs to be clearly understood and supported by everyone in the organization from the mail girl to the managing director, if not in specific detail, at least in broad outline. If the strategy is not understood it serves no purpose whatsoever as a guide to action at any level (and in particular at a customer facing or resource allocation level) and if that is the case there is no point wasting time developing a strategy.

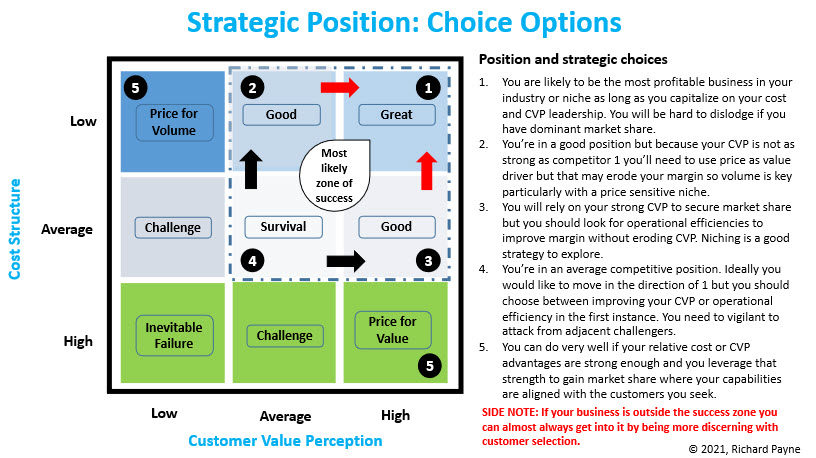

One way to get a sense of what an organization’s strategy looks like is to use a visual representation. The figure 1 below reflects the 9 box intersections between the relative cost of creating and delivering customers’ perceived value proposition. Potential market size is the third dimension to consider.

Figure 1

An organization in position 9 would enjoy a dominant competitive position in the sense that it has the lowest relative cost and the highest CVP. In reality, in each case it may be within a band of intersecting low cost and high CVP. Such a firm would be said to have strong pricing power because it’s offering high customer non-price value and could, by virtue of its low cost structure, charge lower prices to increase its market share or charge higher prices to capitalize on its superior customer value offering. Its pricing strategy will depend on management’s assessment of the price elasticity of demand for its product (it would tend to charge lower prices if the price elasticity is >1 and higher prices if elasticity is <1) or a more “strategic” issue by, for example, raising the barrier to entry into the industry by charging a price that firms contemplating entry simply can’t match.

At the other extreme you have the worst case firm. It offers the lowest CVP and has the highest cost structure, That business has a limited life unless it has a significant capital base and a plan that it believes will enable it to be competitive on price and/or customer value. Most firms in this category struggle to get off first base and never do unless they execute a strategic plan to successfully grow.

An existing organization could take a top down view of where it’s positioned in the 9 box figure and then take a look at the strategic options open to move towards boxes 7,8, and 9. What I particularly like about this visual presentation is the ease with which you can use it to explain quite complex ideas in fairly simple terms. There will be many ways (choices) open to a business to reduce cost but care needs to be taken not to trade off perceived customer value in the process of taking one of those choices. Realizing that trade offs are inevitable when any lever of change is moved is the first step in making choices that turn out to be good ones.

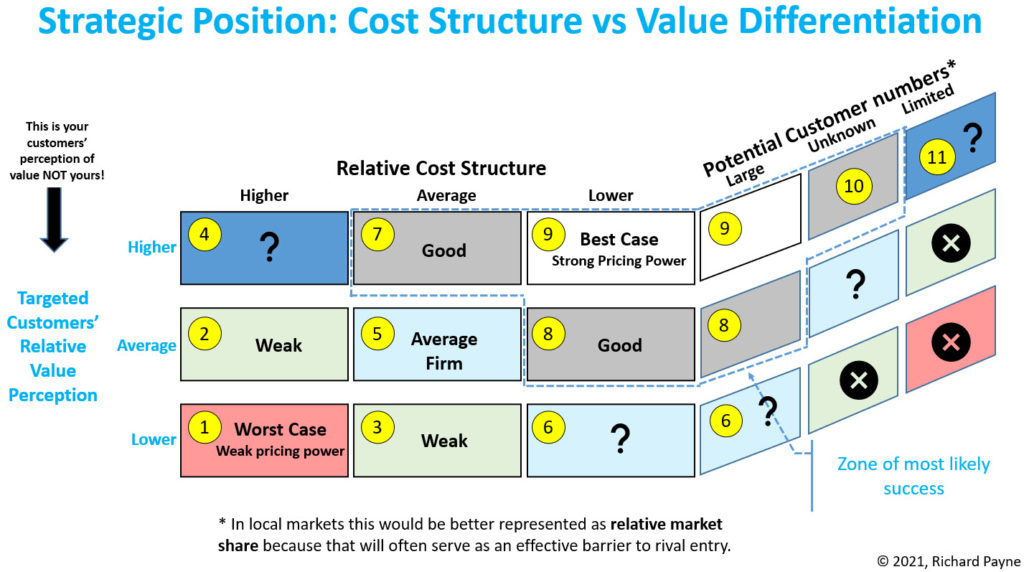

As you go through each of the other intersection it’s possible figure out what the strategic alternatives are. This is reflected in Figure 2.

Figure 2

For example, a firm deemed to be in box 7 enjoys a high level of perceived customer value. For it to improve its pricing power it needs to work on cost effectiveness rather than allocating resources to improve the perception of its product or service. But it should do so in a way that would be difficult for rivals to copy.

Whereas, a firm in box 8 is in a strong cost position and should focus on improving the customer value proposition. One way to do that might be to take advantage of its low cost and lower prices. But this is where strategy gets interesting because it calls on management of the box 8 firm to think through how a rival already in box 9 might respond. It might have a benign response if it deals with a different customer segment to firm 8, or if firm 8’s product offering was only of minor interest to it. On the other hand if both firm 8 and 9 served the same customers with the same or a similar product any attempt by firm 8 to win market share by price discounting is likely to lead to a price war that will erode both firms’ profitability.

In other words strategists need to be thinking not just about their own business and customers but also about its rivals and their customers. Take a firm in box 7 for example if it enjoys the same CVP as the firm(s) in box 9 it would be wise to match (or even raise) its prices relative to firms in box 9 while it works quietly on reducing its cost structure. One advantage of this is changing prices is totally visible to your competitors and easily matched by them and if they have a lower cost structure you’re going to be in trouble. On the other hand working to reduce your cost structure is invisible to competitors and therefore much less likely to invite retaliatory action and yet it will improve your margin and therefore your ROIC.

So although firms in box 9 might on the surface appear to be in a favored position it’s distinctly possible that there will be firms in boxes 7 and 8 that have a higher return on invested capital.

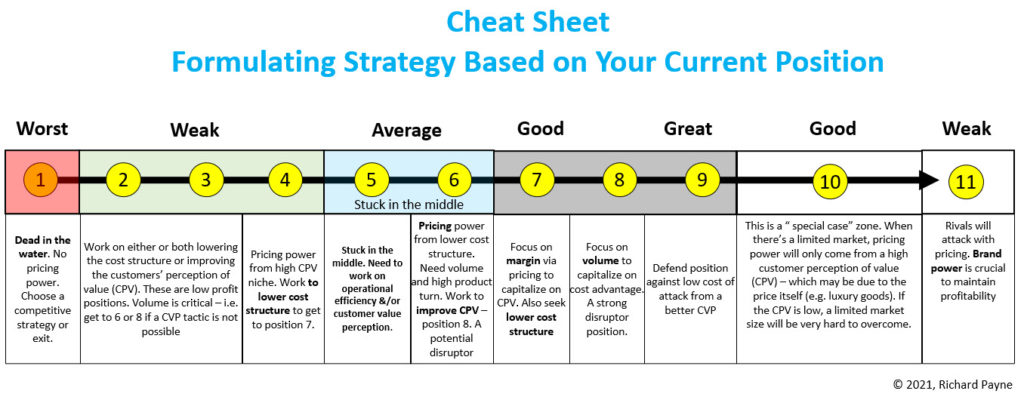

Figure 3 summarizes the choice options you could discuss with business clients who fit withing one of the 9 boxes and having regard to the market size they have.

Figure 3