In 1972 I was employed as a research officer in the wool marketing section of the Bureau of Agricultural Economics in Canberra. A Kiwi colleague of mine suggested that we start a retail store that sold sheepskins and related products. We were joined by a third friend and we each contributed $300 and it turned out to be very successful with revenues of close to $1million in its first year.

Listen here or read below

Fairly early on I visited with our accountant who was referred by a friend and asked if there’s anything I should be aware of and his advice was just to keep a multi-column cash book and keep all our expense receipts and sales records then bring them in at the end of the financial year. I did that and his only comment was you guys seem to have done well, keep it up and good luck, here are your financial statements and your partnership tax return, we’ll send our bill in due course and would appreciate prompt payment. That was it!

It never occurred to me that he could have helped us better manage the business. It obviously never occurred to him either. I realized that I needed to know more about running a business so I bought a book on accounting and another on small business management. The accounting book was useless for my immediate purpose but a couple of chapters in the small business management book that discussed how accounting information can be used to monitor business performance were very useful. They dealt with cash flow projections, the difference between profit and cash flow, inventory management, cost structure, cost-volume-profit analysis, pricing and its effect on gross margin, profit and cash flow. I had been exposed to many of these concepts when I studied farm management in my undergrad degree but their relevance in business generally never occurred to me.

Fast forward a few years.

After becoming very interested in business, I applied for and was accepted into business school where I ended up taking a bunch of courses that gave me an accounting qualification. The Dean of the school, who became a mentor and good friend, convinced me to pursue a teaching career. His pet theme was that accountants could and should do more to help their business clients and that it was our job, as teachers, to show students how to apply what they learn in an accounting degree to this end.

Frankly, that was not easy for several reasons. First, the students we mainly interested in just getting a degree and a job, not changing the world of business; second, when they did get a job they were not in a position to tell their employer what they should be doing; and third, by the time they were settled in a firm and doing pretty well financially the only world they wanted to change was their own.

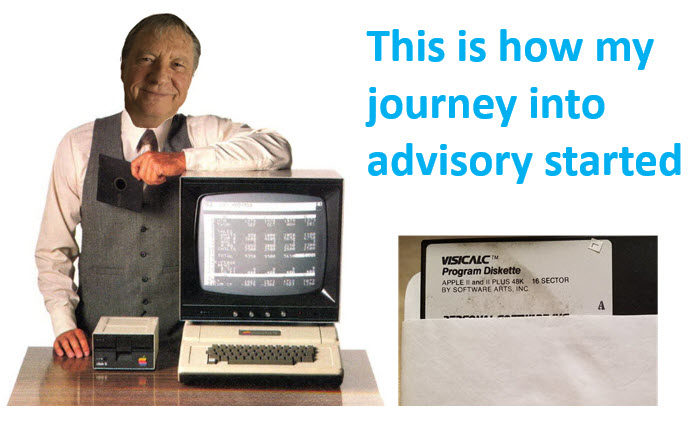

So fast forward another 10 years I figured the best thing to do was to become an employer so I got out of teaching and bought into an accounting practice. That was in 1983. In that year something special happened which was to change everything. The Apple IIe was released and a spreadsheet called VisiCalc ran on it. I raced out and bought one for $2,300 ($6,000 today!)

I immediately created a spreadsheet to illustrate the 4 ways to grow the profitability of a business. A year later I added what profit growth meant for the growth in business value.

Being in public practice, in a position where I could make decisions and armed with a spreadsheet I was now able to accomplish four very important things:

First, I could meet with a client knowing that I could engage in a really powerful review of the financial performance of the business rather than just handing over (or mailing) a set of financials and a tax return. This gave real purpose to the meeting which provided a great sales opportunity;

Secondly, I could rapidly undertake an analysis of the performance of their business over the past 3-5 years, showing trends in the form of ratios and percentage changes. This had been unbearably slow and costly with pencil and paper but with the speed of a computer it was possible to clearly illustrate the story that the ratios told about the profit and cash flow performance of the business;

Thirdly, I was able to do What-If analysis to rapidly show a prospect the impact that very small improvements in key profit and cash flow drivers can have on profitability, cash flow and business value growth;

Finally, VisiCalc made it possible to easily and time-effectively prepare cash flow and profit projections which could be used to determine funding requirements and sustainable growth rates.

This was literally mind-blowing for clients. Clients left my office with a smile and a report printed on a dot-matrix printer and were delighted. The sales opportunity this presented is amazing because it shows how value captured is a function of value created which is almost impossible to do manually with pen and paper.

It was an opportunity to teach clients what the various financial ratios meant and how to understand and appreciate the significance and value of their financial reports. It turns out this is a very good way to build rapport and give the client confidence that I knew what I was doing. It also positioned the accounting role in a better light when clients realize the reports contain valuable insights into what’s happening in their business and we are not just a tax-driven necessary evil.

I considered this process to be the start of an advisory project because it gave me an opportunity to have a conversation about “moving from the numbers to the numbers” by putting in place initiatives that would “move the needle”. But the really important thing to note here is you must have a good sense of what those initiatives might be because that’s where the value creation starts, it’s not the dashboard, the What if analysis, or the projections.

I had been lucky to spend close to 10 years teaching management accounting, financial management, management decision theory, entrepreneurship, and strategic planning so I had a reasonably good idea about what drives profit and value growth. It’s never good enough to alert a client to a falling gross margin. Value is only created if you can explain what a gross margin is, why it’s important, what’s the likely cause of its decline, what impact that has on profitability and cash flow and, most importantly, what can be done to fix it. That advice never comes from just looking at accounting reports. It comes from conversations based on analytics plus experience and an understanding of your client’s business processes.

The personal computer plus VisiCalc is a tool that made it possible to rapidly identify a business challenge and therefore create an opportunity to offer advice on how to fix the problem. But the point I want to strongly make is that I never considered advisory to be simply pointing out what’s not working and then expecting your client to go away and fix it. That’s the beginning of the advisory process and the real value is added from that point on. It’s important to understand that hardware and software are just tools that are essential for giving guidance. But like a map, they are not the terrain they reflect.