When you put a service proposal in front of a client she will make a decision to go ahead with the proposal or reject it. If she was acting as a rational economic agent she would assess the potential payoff against the expected cost of the proposal and she would go ahead with the proposal if the payoff exceeded the cost. In the real world it’s more complicated than that and the way you frame your proposal can have a dramatic impact of whether it is accepted or rejected.

The reason it’s more complicated is humans don’t always make rational choices. Consider the following example:

Suppose you can set up your client’s affairs in such a way that there are three possible outcomes. For present purposes let’s assume you present your client with all three proposals and ask her to choose whether she wants to pursue any of them and if so which of the three would she prefer.

Proposal 1: You tell her you’re certain to be able to help her reduce her tax by $20,000 with a few simple adjustments to her affairs. We’ll assume because this is such a simple solution you will not charge a fee so her obvious gain is $20,000.

Proposal 2: You explain that by adopting a more aggressive approach you believe there’s an 80% probability you’ll be able to reduce her tax by $25,000 but there’s a 20% possibility of no saving. Again, we’ll assume there will be no fee to implement this.

Proposal 3: You explain that this project is more complex than the other two and requires your expert attention so your fee will be $10,000 but you believe there’s an 80% likelihood of her saving $37,500 in tax.

Now, put yourself in your client’s shoes. On the assumption that you have decided to go ahead with one of the three options (which, by the way, is not always an obvious choice), which would you choose?

Did I hear you say proposal 1?

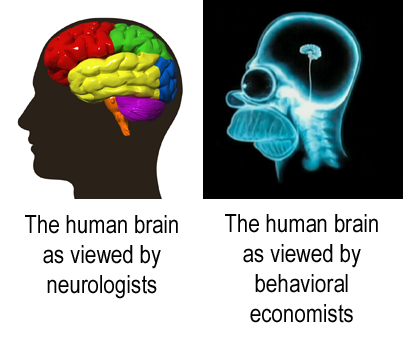

Most people will opt for the “certainty” scenario even though all three of them offer the same expected value which is $20,000. If she acts rationally she would be indifferent. But she is not being rational in the manner postulated by an economist’s concept of bounded rationality, she’s being human.

In 1979 Daniel Kahneman and Amos Tversky published an article called “Prospect Theory: An Analysis of Decision Making Under Risk” that turned the traditional ideas about human rationality on its head. Tversky, unfortunately, died in 1996 but their work led to Kahneman, a psychologist, being awarded a Nobel Prize in Economics in 2002.

Kahneman’s work has been popularized in his book Thinking Fast and Slow. It’s a very interesting book that will not only give you insights into prospect theory but also how and why we think the way we do and how choices are made that determine the outcomes we experience in business and life.

Prospect theory is built on several fundamental ideas that come into play when you are presenting a proposal to a client.

First, you and I are hardwired to have an aversion to risk or perceived risk and the subjective value we place on gains (or expected positive outcomes) is less than the subjective value we place on losses (or expected losses.)

As an interesting aside, this is why humans have survived to become the dominant animal. Loss aversion is conducive to survival and procreation and those of our ancestors who made it through and bred were able to do so because they took less risks in what was, until about 50,000 years ago, a very risky environment–the risks we face today are much less likely to kill us but our brain still works the same way it did back then. In an environment in which there is very little risk to our survival they way the brain is protecting us is actually causing us to miss opportunities for growth.

Research by Kahneman and many others has validated the risk aversion hypothesis and has revealed that the premium people seem to require to equate the subjective value of potential gains and losses is at least 2:1.

Research by Kahneman and many others has validated the risk aversion hypothesis and has revealed that the premium people seem to require to equate the subjective value of potential gains and losses is at least 2:1.

The implication of this is that when you are looking for business development candidates it’s important that the expected increase in profitability be at least twice your expected fee. Which, incidentally, this is what I learnt through personal experience 30 years ago and have been teaching for the past 20 years but I did not realize it has a solid theoretical as well as empirical foundation.

A second idea in Prospect Theory is people use reference points (or anchors) to determine value of a product or service and their choices are influenced not by the expected end state of the decision but the change relative to that reference point.

To the extent that you can modify the context to influence where that reference point is positioned in your prospect’s mind you can influence a buyer’s value assessment and therefore the purchase decision.

The implication of this is when you put a proposal to a client to charge a fee of say $40,000 for a BD project her mind will attempt to relate that to some other fee e.g. what you charge for her other work. Furthermore, because she may never have been presented with a BD proposal before the whole experience is foreign and that uncertainty is enough to result in her retreating to the safe haven of the status quo i.e. rejection of your proposal.

This is why it’s critically important to establish an empathetic relationship that leads to trust. I discussed this in my February, 2014 web conference when I discussed selling BD services in an Initial Consultation – click here to view the presentation. This is important because trust results in your prospect accepting the reference point you position.

The starting point for your prospect’s decision would typically be the status quo. If you present the proposal by opening with a statement like “your investment in this process will be approximately $40,000,” her new starting point becomes -$40k (i.e. a loss of $40k). You may then go on to say the Profit Improvement Potential is e.g. $120k but her focus will be on the certainty of the $40k fee not the relative uncertainty of the $120k PIP.

On the other hand you’re likely to have more success if you frame the proposal by saying something like:

Our fee for this project will be in the order of $40k and after factoring that into the PIP your return will be a net $80k in the first year, after that we estimate it to be $120k. In addition to this, the value of your business can be expected to increase by $360k (assuming a capitalization rate of 33%) so in the final analysis your financial position will have improved in the first year alone by $440k being made up of and additional $80k in disposable income and a business value increase of $360k.

By framing the proposal in this way you are netting the gains and losses and in the process you’re changing the reference point that she uses to make a value judgement. Try this.