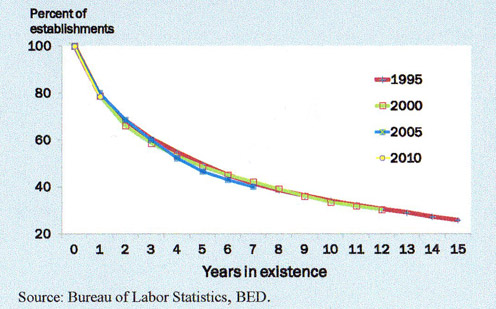

Studies of business survival over many years reveal a disturbing fact: five out of ten businesses do not survive more than five years and as few as 3 out of those that do survive the first five years live to see ten years. The Figure below shows this not-very-pretty picture and while it’s based on US data the same remarkably consistent pattern shows up in every western country I have seen data for so I feel comfortable in suggesting that it’s a fundamental law of the nature of enterprise and reflects what Austrian-American economist Joseph Schumpeter described as the consequence of “the gale of creative destruction.”

It is important to note that the survival data does not necessarily mean the businesses that closed were financial failures. People close a business for a variety of reasons other than financial stress but many of them were financial catastrophes while others closed because they yielded such a small return for effort their owners just shut the door.

The underlying reason for the financial failures and the personal cost (which is both financial and emotional) to everyone involved is these businesses run out of cash and that happens for a variety of reasons which include the following:

- They grew too fast and could not finance their growth – that is, they were under-capitalized

- The owners took too much out of the business – that is, they consumed more than they contributed

- They implemented a flawed business model or poorly executed a sound one

- Their products and/or service protocols failed to meet customer expectations so they lost customers to rivals

- The market they targeted was not large enough

- There was a decline in customer demand as a consequence of changing tastes

- Their position in the industry value chain was squeezed from increasing pricing power by suppliers or customers

- They were out-competed by rival firms who offered a better customer value proposition and picked up greater market share

- Their industry was disrupted by a new business model introduced from outside the industry

- The owners lost interest in the business and took their eye off the ball

- A family tragedy occurs that was not prepared for organizationally

- One or more key team members passed away, retired or left the business to work for a competitor, start a rival firm, or seek a different career path.

You might argue that bad luck plays a role in the failure picture but if you accept the idea that luck sits at the intersection of circumstance and preparation I would argue that, with few exceptions—perhaps government bumbling and intervention or a natural disaster being examples—it’s a lack of preparation that’s the cause of a business to fail or barely survive.

There are probably other reasons than those I’ve listed above but I suggest they all come back to poor management due in large part to a failure to understand the fundamentals that relate to the money side of the business.

You may be wondering why I have not mentioned lack of profitability as a reason for failure in the above list of causes. There are two reasons for that, one relating to excessive profit growth and the other relating to losses.

Even very profitable businesses can, and do, fail with monotonous regularity. If you didn’t know that, you need to bone up on financial management fundamentals because excessive profit growth can be a critical business risk that has to be anticipated and carefully managed.

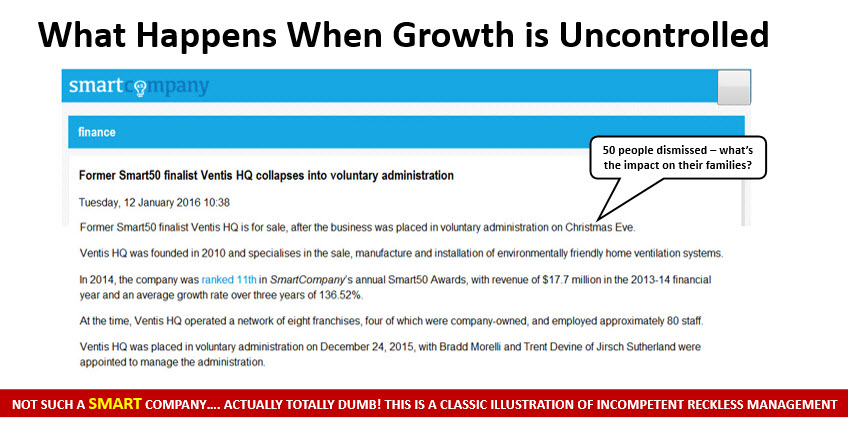

There is a dominant business logic that says the more you grow your revenue the more profit you’ll make. This actually makes intuitive sense but there’s another side of the equation you need to consider. And that is you’ll also need more financial resources to support the revenue growth e.g. you’ll be carrying more receivables, you’ll probably be carrying more inventory, you’ll probably need more fixed capital to provide additional capacity and …. dare I say, often the revenue growth is achieved at the expense of gross margin through discounting and/or offering costly additional value. This has the effect of reducing profit available for re-investment.

It’s significant to note that the popular business media celebrates revenue growth as a success metric in the form of competitions for the top 100, 500 or 5000 firms etc. Sadly, many of these fail not too long after the celebration has ended. Here’s an example from SmartCompany, an Australian business media organization.

Profit or loss is what’s left over after all your business revenues and expenses are accounted for. If a business is unprofitable for long enough it will certainly fail because it will run out of money, but if that happens it will be because one or more of the causes outlined above have come into play and was not appropriately managed.

The factors that lead to failure in the early years are typically financial in nature and those that apply in later years tend to be strategic and personal in nature. Given that you will not get to year ten, and therefore can’t possibly build significant business value, unless you get through the first five years it should be obvious that understanding financial management fundamentals is arguably the most important aspect of creating wealth through small business ownership.

This is where an accounting firm that already has credibility with “the numbers” side of a business can provide invaluable assistance to business managers particularly in the early years. If you can help your clients get a handle on financial management fundamentals that knowledge will stay with them forever and you’ll find the more you “teach” them the more they will come to rely on you as not only a trusted advisor but a key business partner for a long time.

Once you have a client’s confidence it will be easy for you to be invited to help with some of the strategy issues that will arise as their business moves into a controlled growth phase. This is where the real value can be created and captured by you.