Few people question the important role private companies play in contributing to the health and well-being of the nation. These businesses are responsible for more than 50% of non-farm GDP and 65% of new job creation so when they’re in good shape the nation is in good shape. The last 6 years have not been kind to small business but maybe things are getting better.

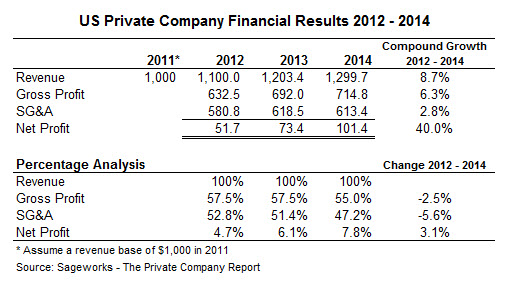

According to The Private Company Report issued quarterly by Sageworks, year-on-year revenue growth has been compounded at 8.7% since 2012 and although the average gross profit margin has declined by 2.5 percentage points net profit has grown at a very impressive compound rate of 40% per year over the past two years.

From the available information it’s obvious that this result has come from quite a significant increase in revenue accompanied by a much smaller increase on overheads i.e. S,G&A as a % of revenue has actually fallen. This probably indicates that inefficient businesses have been purged by the recession leaving market share at relatively low cost to the businesses that have been able to survive.

However, gross profit has grown at a slightly slower rate than revenue which is reflected by the reasonably significant drop in the GP%. That will arise for one or a combination of two reasons: average prices have fallen or COGS have risen. Management needs to keep a close eye on this because as the GP% falls the break-even level of revenue rises for any given level of overhead and the margin of safety shrinks and so business risk increases.

This is the sort of analysis and conversation you should be having with your clients. It would help if you also knew the number of transactions that were reflected in revenue because then you could make some judgments about the volume and pricing impacts on revenue.

Apart from being greatly concerned about the level of public debt the Sageworks report together with some other (often patchy) positive economic news that has been coming out in recent months gives cause to be cautiously optimistic and maybe it’s time for business managers to be thinking about planning for continuing growth. After all, business cycles tend to look like the pattern shown in the figure below.

I believe it’s fair to say we’re not at the top of an economic cycle but whether we’re going into, at or coming out of the bottom of a cycle I’m not sure but my guess is we’re in that space so on the balance of probability, the future seems to look brighter than that past.