At 99 degrees water is merely hot, at 100 degrees it turns to steam and can move locomotives. Just one degree—a one percent change—makes the difference. This is a great metaphor for business. It is always the little things, the small improvements, that yield big results. Let’s take a look at the impact that small improvements in the key drivers of profitability have on the bottom line–you could have a conversation with your clients along these lines.

The key drivers of profitability are price, variable costs (that is, those costs that vary in direct proportion to sales revenue and which typically are represented by the cost of sales), the physical volume of sales (that is, the number of transactions) and finally, fixed costs or enterprise overheads.

To illustrate this consider a business that has the following financial performance characteristics:

| Revenue | 2,500,000 |

| Cost of sales | 1,700,000 |

| Gross profit | 800,000 |

| Fixed expenses | 700,000 |

| Net profit | 100,000 |

| Gross profit margin | 32% |

| Net profit margin | 4% |

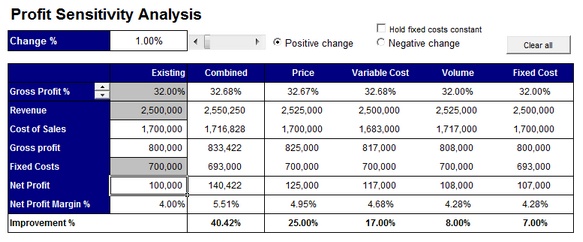

A 1% improvement in each of the four profit drivers for this hypothetical business will yield a 40% improvement in net profit! An increase in profit of $40,000. This is shown in the graph below that is produced by a module in GamePlan called Profit Sensitivity Analysis.

What’s important to notice is the fact that for this business, the 1% improvement in price has more than 3 times the impact of a 1% increase in sales volume and nearly 4 times the impact of a 1% reduction in fixed costs. This is shown in the screen shot below.

While the relative impact of price compared to variable costs, volume and fixed costs will depend on the financial characteristics of the business, it will always have a greater impact than any of the other drivers and usually that impact will be in the order of more that two to three times that of the other drivers.

The reason for this is quite straight forward. An increase in price for a given volume of transactions means that not only will total revenue increase but so too will the margin (price minus variable cost) on each transaction. A reduction in variable cost will change the margin but not the level of revenue. An increase in volume will increase revenue but will not change the gross profit margin and a reduction in fixed costs will have no impact on gross profit at all. Interestingly, reducing fixed costs will always have the smallest impact.

For example, in this hypothetical business, fixed costs would have to reduce to $625,000 to achieve the same result as a 1% increase in price.

If you look at a larger change such as a 10% improvement which will take your GP% to 38.18%, the differences are even more dramatic. With this scenario, a 10% price increase will increase net profit to $350,000 whereas a reduction in fixed costs of $350,000 (43% reduction) would be needed to yield the same profit.

You might be thinking “that’s all well and good in theory, but if I put my prices up by 10%, how much business would I lose?” That’s a good question but a far better one is, “how many customers could I afford to lose without being any worse off?” For this business, the answer is 24%. This would result is a reduction in total revenue of about 16% given a current GP% of 32%.

In other words, you could lose 24 out of every 100 of your “average” customers and be no worse off. And if that were to happen, which 24 customers do you think you might lose—we suspect it will be the 24 people who are price sensitive and who keep reminding you and your team of that. You might also want to remember that a 24% reduction in the number of people you service will take the pressure off you and your team members and will, in all likelihood, enable you to cut back on some of your fixed costs.

The strategic implications of this type of analysis are very important. Most business people are pre-occupied with getting more revenue—often from new customers. They pay very little regard to the customers they already have and usually adopt the view that price is something over which they have very little control because of competitive pressure. They also believe that seeking ways to reduce costs is the most effective way to build a profitable business.

This is absolutely the wrong way to run a business even though it may seem to make intuitive sense that the more revenue you generate the bigger, and therefore the better, your business will be. It also makes intuitive sense that cost reduction leads to improved profitability.

Let’s first address the cost reduction strategy. We have no argument with the proposition that reducing costs (whether they are fixed or variable) will improve profit. But there is a big qualifier to this. If a cost is necessary for you to do business, then reducing it may also reduce your capacity to do business.

Furthermore, the costs that can be reduced are generally those of a “discretionary” nature and these tend to be the ones incurred today to build the future of your business (for example, marketing, team training, research and development.) A more useful strategy to pursue is to constantly review your costs and ask yourself the question “what are we getting for what we’re investing here?”, and related to that, “is there a way for us to get greater productivity from the resources that are driving these costs?”

Chasing new revenue and the activity that involves is a major cost driver in itself. While we tend to describe enterprise overheads as being fixed costs, they in fact aren’t in the long run. They tend to be driven by the volume of transactions. If that was not the case every business would find that its net profit margin (that is, net profit divided by revenue) would increase over time. That is rarely the case in practice.

By far and away the most profitable strategy is to aggressively price your products or services, elect to deal only with those customers who see and accept the value you deliver to them, do not allow customers (or competitors) who are price sensitive to dictate the pricing strategy that you adopt across the board and do not see “big” as being the definition of success and monitor the productivity of the resources that are provided by your fixed costs. At the end of the day, profit is the only measure of success. Revenue does not pay the bills or give you the resources you need to grow—that comes from profit.