Steve Ballmer, the ex-CEO of Microsoft, is one of the wealthiest people in the world. While doing some research on Microsoft’s strategic positioning over time I came across the following questions: how much is Ballmer worth? Answer: $81.252 Billion. And how did he make his money? Answer: he owns 333 million shares in Microsoft.

That’s the wrong answer!

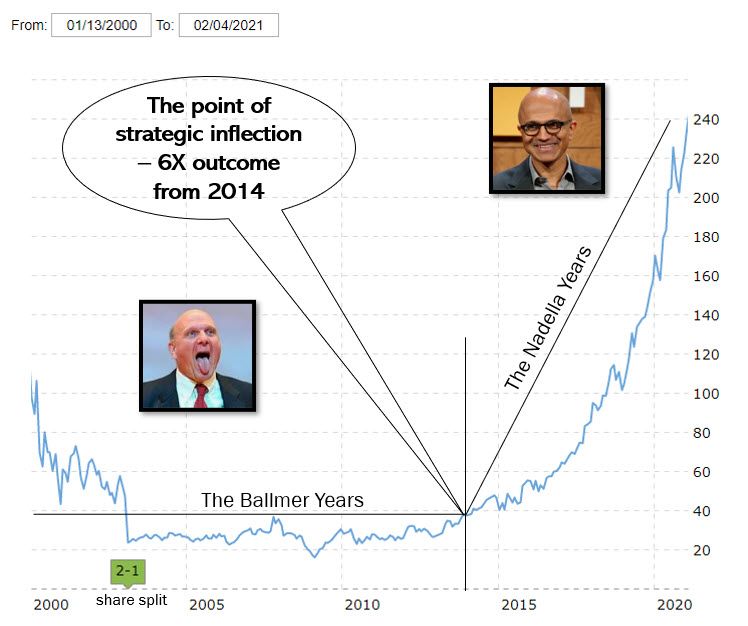

Ballmer replaced Bill Gates as CEO of Microsoft on Jan 13, 2000. It’s hard to know what the shares owned by people are “worth” because of share buybacks and individual sales but the share price at the time Ballmer became CEO was about $100. By the time Nadella took over, the price had dropped to $57 and after a 2:1 split in Feb 2003, the price in Feb 2021 was $244.99. To put some numbers on that: for every 100 shares that Ballmer owned at the time he took over his wealth was $10,000, by the end of his tenure of leadership his wealth was 200 shares at $57 or $11,400. By 2020 under Nadella’s leadership Ballmer’s wealth had grown to $48,998 – a fivefold increase on what he started with.

Satya Nadella took over from Ballmer in February 2014. The graph shows what has happened to the Microsoft share price since 2000.

With tongue in cheek, I included a picture of Ballmer and Nadella to illustrate the essential difference between the two CEOs. When you look at the share price and consider what was happening at companies like Apple, Google, and Amazon it doesn’t take a genius to figure that something wasn’t right at Microsoft.

Almost from the moment Nadella took over the share price started rising. Part of the reason for that can be explained by the 330% increase in the NSADAQ index. But the big point is that even allowing for the stock split Balmer presided over a no-growth result throughout his time in the CEO seat.

So, to answer the question how did Ballmer make his money? He and his Board hired Satya Nadella and Nadella changed the company’s direction. That’s what created his current level of wealth.

Nadella immediately took Microsoft in a different direction which is code for changed the company’s strategy. Two things Nadella apparently said after he took over were: first “one of Microsoft’s biggest mistakes has been to think of the PC as the hub for everything for all time to come” and “the ability to change our culture is the leading indicator of our success” and he set about working on taking it from a “know-it-all culture to a learn-it-all” culture. Apparently, every conference room in the company now has a banner that looks like the one below to remind people what that means.

He also re-directed resources from the Windows division to Azure – its cloud business; in fact, he virtually closed the Windows group by re-deploying staff to the Azure and Microsoft Office teams. This is a classic example of “moving to where the puck is going to be” to use Wayne Gretzky’s famous saying.

If growth in revenue, profitability, and share price are accepted as indicators of business success, clearly, strategy is important.

Based on this example, what then is business strategy? It is the process of deploying resources in their best and highest use to accomplish a given goal having regard to current and emerging opportunities and technologies in the market space a business chooses to be in.

So that brings me to the second point I want to make which is probably more important.

According to Hamer & Zanini, in their latest book Humanocracy, Balmer and Gates made several mistakes due in large part to their mindset that had served them well for many years. For example, they believed the way to make money was to sell licenses, not software as a service. They believed the company’s customers were CIOs not individuals or teams, they did not see the phone as anything but a phone and Balmer even loudly shared his view that the iPhone would never gain any reasonable market share. The bottom line is that Microsoft’s business model was no longer serving it well and that probably started to have effect from around 2000 if the trend in its share price is any indication.

Everyone suffers from being influenced by a legacy mindset which is one of the reasons founders of successful companies often find themselves addressing stagnation or failure as their company matures. But as Hamel & Zanini say, “The real culprit was bureaucracy. In a hierarchical organization, the responsibility for setting strategy and direction is vested in a handful of senior executives. Those at the top are expected to be uniquely farsighted, inquisitive, and creative. In practice, that is not often the case.” They go on to suggest that the problem is “the unwillingness or inability of senior leaders to write off their own depreciating intellectual capital.”

I think this is a major contributor to the malaise that so many good professional service firms find themselves in after a decade of strong growth. Legacy mindsets cause senior people to believe they know how their business should operate, this leads to a command-and-control organization structure that is hierarchical, decision rights are assigned by seniority, and innovation at the coal face is not encouraged. Look at what happened to Kodak because it wouldn’t let go of its legacy imaging business and to add insult to its injury, it even invented digital photo technology.

It’s little wonder that Gallop reports in its 2018 study when asked if they were “involved in, enthusiastic about, and committed to work” 53% of US workers we not engaged and a scary 13% were actively disengaged meaning that they were engaged in anti-engagement activities within the business. Gallop also reports that it’s even worse globally.

When you see these numbers it’s easy to understand why the current ideas about organization design are failing and failing badly. Click on this link to find out more about Gallop’s research and get their Q12 level of engagement set of questions. Ask your team to compete the Q12 questionnaire anonymously and then think about what changes you might need to implement in your business in terms of both structure, and management style. You can click here to download my own take on the Gallup survey and see an example of how another company reviewed its results.