You’ve probably heard that if you drop a frog into a pot of cold water and slowly bring it to the boil the frog will, in the first instance, adapt to the rising temperature but will ultimately succumb to the heat and die. On the other hand, if you throw a frog into a pot of boiling water it will immediately jump out and proceed on its merry way.

This presents a terrible visual and I have no intention of testing the hypothesis. However, I did want to use it as an analogy for how a business manager is likely to react to a change in gross margin.

Gross margin is one of the most important metrics you can extract from a financial statement because it represents what’s left after variable costs are covered to contribute to other expenses and profit. I am appalled at how many business people do not understand just how important this metric is and how few accountants take the time to thoroughly explain it to their clients.

On the assumption that your client does understand its significance, a second challenge arises and that is a phenomenon I like to call the slow margin death march. Here’s what I mean by that and how it relates to frogs and hot water.

If your client’s financials reveal a sudden drop in its gross margin percentage it should, and usually does, cause alarm bells to ring loudly. The magnitude of the change gets noticed and what gets noticed usually gets acted on. For example suppose your client has a $2 million business and the gross margin drops from 40% to 35% the impact on the bottom line is a reduction of $100k. For a $2m business that’s a significant chunk of change and could easily represent 50% or more of its profit.

However, if this margin decline happens over say a period of five years at the rate of 1% point per year its impact on the bottom line is exactly the same but it tends not to be noticed because the year on year change is relatively small.

This is failure to notice the change even more likely to happen when revenue is increasing because of more activity. In this case the total gross margin may be increasing but you’ll often see a corresponding increase in operating expenses driven by the increased activity.

You might argue that it doesn’t matter if the gross margin % falls as long as the total gross margin rises but that argument only holds true if there isn’t an overall negative impact on the bottom line. The only caveat I would add to that is the possibility that this is part of a change in strategy that is expected to ultimately result in an improvement in profitability.

As a practical matter, the caveat I have referred to above is something I have rarely seen. In the ordinary course of business there are five reasons for a decline in gross margin %. They are:

- Average prices are falling while variable costs remain constant

- Average prices are falling while variable costs are rising

- Average prices are constant while variable costs are rising

- Average prices are falling at a faster rate than variable costs are falling

- Average prices are rising at a slower rate than variable costs are rising

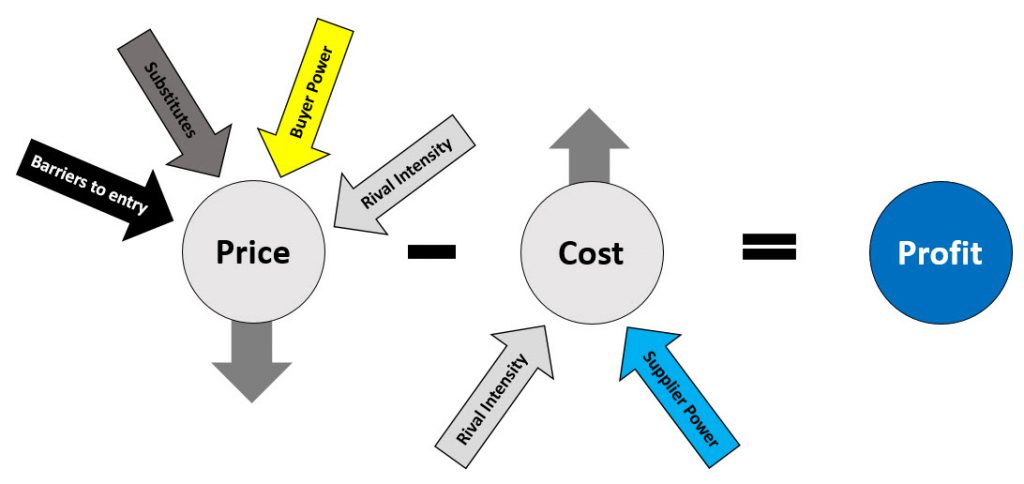

A characteristic feature of business today is the fact that there’s always inexorable downward pressure on prices and at the same time suppliers are constantly looking for ways to increase their prices because they too are subject to constant upward pressure on their costs. This is very well illustrated by looking at the way Michael Porter’s five forces of competition are always in play driving prices down and costs up.

Needless to say, if your client is one of the 45% of businesses that do not have regular (as in monthly) management accounts there’s no point even discussing this. This is like someone going to a doctor because they feel sick and being told to come back in 12 months so their temperature can be taken. It’s important to investigate the reason for any change in a gross margin % and to put an action plan in place to address the cause. The metric itself is a consequence of circumstances and, like a thermometer, the number is not important in and of itself. What’s important is the cause of the decline because once that’s been identified something can be done about it.

Let’s assume that decent accounts are available because the client is using a cloud accounting system. I always used to start with a product-line gross margin analysis and I looked very closely at what products accounted for 80% of the total gross profit …. as an aside I also looked at the inventory for each of those products so I could calculate their respective ROI. Inevitably there are a bunch of products (and customers) that need to be dropped even if this means a temporary reduction in revenue and may be lead to a reduction in activity-driven operating expenses as well.

I would then invite my clients to think deeply about the value proposition they presented to their customers and in particular what Porter refers to as the non-price elements of that. More often than not you’ll find the value they bring to the table for the customers they can have a long term profitable relationship with is such that they do not need to be so price sensitive. An extremely useful resource to help you do this is Alex Osterwalder’s book Value Proposition Design, and if you’re serious about helping your business customers, check out the many YouTube videos Osterwalder and others have done on this.

On the other hand, if you discover the market for your client’s products or services has changed to the point where price is a key competitive issue they have a simple choice: find a way to lower their costs, get out of the industry, or change their business model.

Oh and one further thought.

Don’t believe that you’re creating value by giving your clients a fancy monthly dashboard that reveals movements in various metrics including their GM% by means of gauges and graphs. In this day and age with technology being the way it is, this is just a table stake. It is no more valuable than a monthly income statement was 20 years ago. The value comes from the conversations you have around the numbers. Sadly way too many people think their “dashboard services” are differentiators. They aren’t. They’re actually worse than useless unless you educate your clients on how to use them to run a better business.