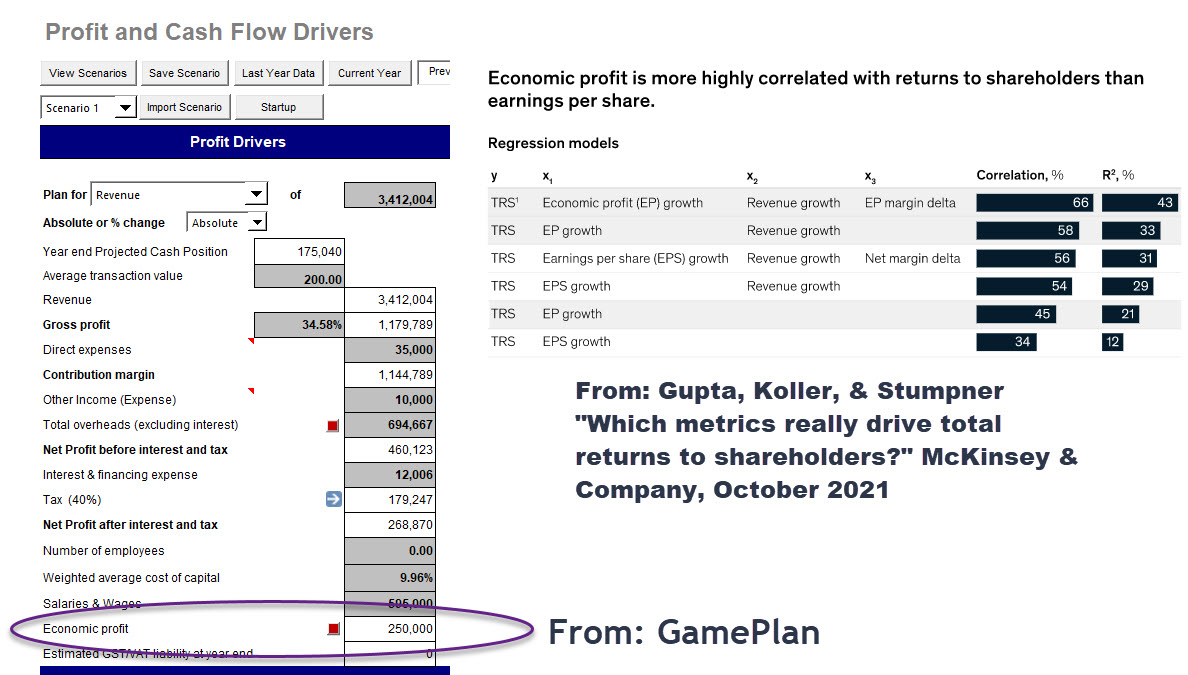

It’s comforting to see that GamePlan and its predecessor has always provided the ability to assess and plan for Economic Profit in addition to other net profit metrics such as net profit before and after tax etc. because

Economic Profit is the only metric that reflects the impact on shareholder value creation. We included it in our application to give business advisors a framework for a conversation on the concept and process of shareholder value creation and its relationship to profit improvement and business value.

More often than not businesses are not covering the full cost of capital employed because the cost of equity is excluded from the calculation. In small businesses the owners are often not paying themselves an appropriate wage so the profitability of the business is being overstated; although there are, of course, cases where the business is paying for questionable family employment in which case the underlying profit of the business is being understated.

This is a conversation an adviser should be having with the owners of businesses. It will logically lead to a discussion on what net profit should the owner shoot for having regard to appropriate management salaries, capital contributed, and financial and business risks involved. This is the real stuff of advisory, it is not sitting around looking at pretty dashboards, pointing figures at screens, and uttering mindless popular clichés like “we need to circle back and focus eyeballs on the levers of performance enhancement”.