If you prepare service proposals for consideration by your clients you need to read this post. In my first lesson in microeconomics I was taught that most demand curves slope downwards from left to right. For some products they will be steep and for others they will be flatter but for nearly all products (and services) it is posited that lower price will lead to more sales so we were taught.

This is a logical construct from the concept of a rational economic person acting in his or her self-interest. So far so good. I was taught that other things being equal most people would be seduced by lower price relative to other suppliers and sales volume would therefore rise if prices were lowered.

BUT there are two problems with this conclusion. First other things are never equal – it’s a nice assumption if you’re trying to teach people like me some economics but it does not align with reality if you’re trying to predict actual as opposed to theoretical human behavior.

Second, products are rarely totally “equivalent” in the eye of a consumer – even the fact that if they have a different price attached this is a form of differentiation which, in the absence of information to the contrary, many people will automatically assume a quality premium for the higher priced product even if in fact the quality is precisely the same as the lower priced alternative.

This is why when a Principa member, on our advice, has raised prices to better reflect the value the firm brings to the table, the result is an increase in revenue and net profit because very few clients actually leave the firm and those that do are most often the ones you want to let go. However that’s not the main point of this post.

The point is when people are asked to make a decision involving a value judgment they rarely, if ever, think in terms of absolutes but instead make a relative value assessment and that has a huge implication for the way you position your service proposal and pricing options.

Consider this real world situation and then I’ll come back to pricing a business development consulting proposal.

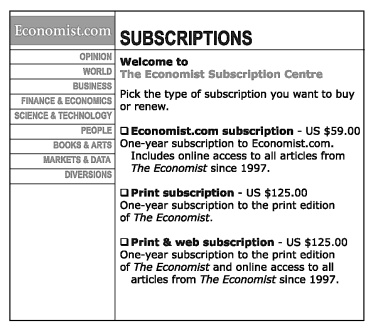

In one of the most fascinating books I have ever read called Predictably Irrational: The Hidden Forces That Shape Our Decisions, the author, Dan Ariely, describes an example of a pricing offer from The Economist – a UK economics magazine. Take a look at this advertisement they put online some years ago. Do you notice anything peculiar? What would your choice be?

To test this question Ariely asked 100 graduate students from MIT’s Sloan School of Management to submit their choice.

Predictably he discovered that none of them selected option 2 – after all they were future business leaders which is comforting. Why, it would obviously be irrational for any sane person select to print alone if it costs the same as print + online access. So here we see economic rationality kicking in with 84% of the students selecting the print + online option for $125 yielding total revenue of $11,444

It is also interesting to note that research has also shown that even if you do not sell any of the higher priced products the mere fact that they are presented for consideration with lower priced alternatives will almost always lead to an increase in sales of the lower priced options.

This occurs simply because people make purchase decisions based on relatives and not absolutes – which means the lower priced option looks good value when set against the higher priced one. So whenever you are presenting a proposal always try to have at least two options and advise your clients to do likewise wherever possible.

You see this everywhere. If, on a rare occasion, you walk into Tiffany’s on Fifth Avenue you’ll probably pass a bracelet on display near the front of the store with a $50,000 price tag on it. With that as framing information the $2,000 one you see in the store looks just as good! Correct?

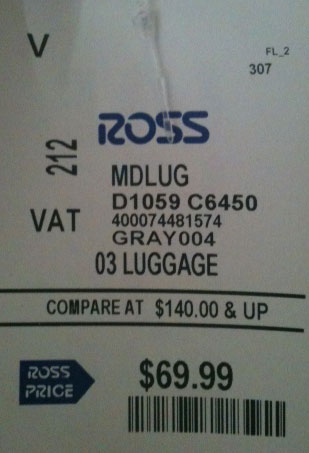

At another (lower) level, Ross Dress For Less, a US retailer of surplus designer brands, has a swing tag on its products that will read something like the one below ~ “$69.99 in bold print with compare at $140 & up” noted on the tag.

That pricing strategy has always been too much temptation for my wife to resist and many clothing items that once hung in Ross or TJ Max now hang in her closet with that very same price tag attached! I’m also guilty – the above swing tag is for a bag I purchased.

But let’s get back to Dan’s work.

He decided to remove the print only option (which he calls a decoy) and offer his student group just two choices. The first was an online subscription for $59 and the second was online plus print for $125. Look what the result was when the students had only two options and no decoy price alternative. Instead of securing 84% at the higher price point that had now dropped to 32%!

Total revenue in this case was $8,012. This is 30% lower than when the decoy was inserted in the offer. Admittedly there would be some incremental costs associated with the print component but it would be a relatively small cost I suspect.

Dan notes that this is not consistent with rational economic behavior but he argues that it is totally predictable. People make choices based on relative value perceptions and that value judgment is going to be influenced by proximate pricing and relative content alternatives.

Because we are comparative animals, as a vendor you need to give customers comparative information for them to make value judgments. Without a service choice the only choice option they have available is to take your offer or not and “not” usually wins out – because we humans are hard wired to retreat ti the security of the secure status quo when presented with an alternative we have difficulty evaluating with some degree of objectivity.

That last paragraph is “worth the price of admission” as I sometimes like to say in my presentations. Always give your clients a choice and if you want to encourage them to select the most valuable choice add a decoy that has a price close to the premium offering but without a substantially different feature component.

Now let’s work with this idea on pricing a business development proposal.

The three options might be something like this (note the prices I have attached to these options are for illustrative purposes only, you should form your own view about this and quite possible after forming a view as to the value your service represents for the client.)

Option 1: $10,750 – A strategic planning session followed by a customer advisory board with the deliverable being a strategic plan focused on a clearly defined target market and encompassing a robust customer value proposition. Payment to be 50% on signing and 50% on completion.

Option 2: $24,000 – Option 1 deliverables plus a facilitated team advisory board, a business process map to identify process improvement opportunities, coordination of the implementation of a cloud based business systemization solution, and the design and development of a management control plan with appropriate KPIs. Payment to be 50% on signing and $4,000 at three agreed intervals.

Option 3: – Option 2 deliverables plus monthly attendance at management board meetings at a fee of $2,000 per month and a minimum contract period of 12 months with the monitoring fee to drop to $1,450 pm in year 2 and renegotiated in subsequent years.

Returning to the Economist example again. If you go online today (at the time of writing) you’ll see they are still using this pricing offer approach but have cleverly re-priced the online version which they now offer with or without the digital option. The decoy is the digital subscription alone. These guys are veteran pricers and they would not be doing this if it was not working for them. The point I’m making here is don’t dismiss this concept.

Finally, the only way to tap into the predictable but natural irrationally of mankind is to test different approaches to pricing, proposal content.

That would be good to cover in more detail in your Webinar Matt. Thanks for your insights.

Ric,

The idea when presenting options in pricing is to go with your highest priced option first and then pare down the offering over the next two such that the final one is the “bare bones”.

In this way, we set the customer thinking process at the “works burger” level and take away components of the offering over the next two options. They will generally want the “works burger” and this will help to set their expectation level. We have been doing this successfully for quite some time now. What we have found is that most customers will take the first option and those that don’t will generally look to move to that option in a fairly short time frame (within 6 months).

From a customer selection perspective, the customers that choose the “bare bones” option are those that we may not want to deal with! When you discuss why they choose this option, you will find out a lot about what motivates them.

We can cover off this in more detail in the upcoming webinar if you like.

Cheers,

M

Thanks for your comment Paul. I miss you too my friend.@Paul Dunn

Thanks for your post Matt. Let’s discuss the order and the structure of the proposal offers. @Matthew Tol

Great post, Ric. And Dan’s book is just great too. The Economist example in there is an absolute classic isn’t it? Love the way you ‘folded’ that in to the proposal example PLUS the way you’ve guaranteed 2 years in Option 2.

Good to see you back writing — I’ve missed you!

Rick,

Agree with your arguments here and the work that Ariely has done is worth not only knowing but understanding. A lot of this flows from Behavioural Economics and it is worth having a look at the following videos to explain and develop the thinking in this area further.

Ariely: http://www.youtube.com/watch?v=9X68dm92HVI

Rory Sutherland: http://www.youtube.com/watch?v=P1mOsHFXZFA

Verasage (www.verasage.com) has been doing a lot of work in and around this stuff for years and I have been using this in my business for quite some time now. It works.

It is also very valuable to take this thinking to our customers as they can gain an immense amount of value from understanding these concepts.

I do have an issue however with the order in which you place your porposal for the customer in your post. Can discuss this further if you would like.

Thanks for the post!